5 Costly Mistakes To Avoid for Home Buyers

Categories

Recent Posts

Canadian Luxury Housing Holds Ground in 2025, with Toronto’s Ultra-Luxury Market Leading

Renting Out Your Property? Here’s Why You Need Landlord Insurance (And Why You Can’t Rely on Homeowners’ Coverage)

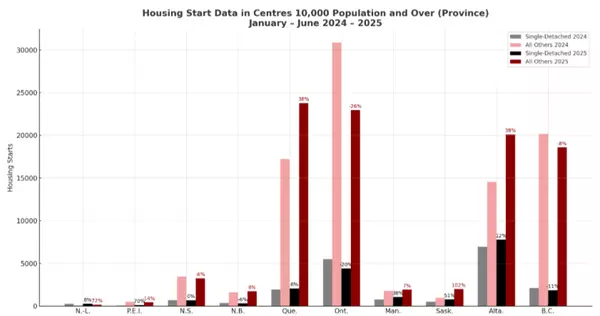

Regional Shifts and Housing Type Trends Shape Canada’s June 2025 Housing Starts

Century 21 Canada Announces Partnership with Propra to Modernize Property Management Nationwide

Regina Targets Core Area Revitalization

Edmonton Adopts New Row House Design Rules to Improve Infill Development Standards

Burnaby’s Zoning Overhaul: Citywide Changes Underway Through 2025

Dunpar Homes Celebrates Reaching the Top

Negotiating Pre-Construction Condo Purchases in Canada: Key Considerations and Strategies

Toronto Rental Trends Show Steady Leasing with Shifting Supply Pressures