Looking Beyond Appreciation in a Shifting Market

In today’s unpredictable real estate environment, investors find themselves navigating a landscape far different from the boom years of rapid appreciation. Rising interest rates, sluggish property values, and economic uncertainty have upended the traditional “buy and hold for appreciation” approach that many once relied on without question. While these changes may feel unsettling, the core truth about real estate investing remains the same: success has always depended on more than just market appreciation.

Facing the New Realities

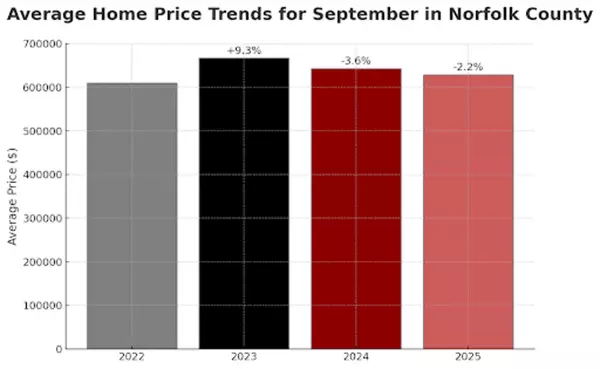

Owners and prospective investors alike are encountering some familiar yet challenging obstacles. Property values in many markets have stalled or even slipped. Higher mortgage rates have been eating into cash flow, making monthly budgets tighter. Financing has become more stringent, limiting access for some buyers. And economic fluctuations create challenges in maintaining stable tenants and consistent rental income.

These factors have disrupted the comfort zone of relying solely on property appreciation as the engine of wealth building. Investors must now adopt a broader lens to safeguard and grow their portfolios.

Why Appreciation Isn’t the Whole Story

For many years, the strategy of banking on appreciation worked—almost effortlessly. When home values constantly increased, many property issues or investments with minor flaws ended up profitable in the long run. This environment masked many risks, leading to a false sense of security.

As Warren Buffett famously noted, “Only when the tide goes out do you discover who’s been swimming naked.” In prosperous times, underlying vulnerabilities are hidden. But when markets cool or recede, weaknesses come sharply into focus.

This perspective should prompt a shift in mindset. Instead of hoping for property prices to climb indefinitely, investors who thrive do so by understanding and leveraging multiple streams of value within real estate.

The Eight Profit Centres Every Investor Should Know

Savvy investors look beyond appreciation to a framework of eight distinct profit centres:

- Instant Equity — Buying properties below market value or making improvements to increase value immediately.

- Positive Cash Flow — Ensuring rental income exceeds expenses on an ongoing basis.

- Principal Paydown — Building equity through regular mortgage repayments over time.

- Leverage — Using borrowed capital to scale portfolios and increase potential returns.

- Tax Advantages — Utilizing deductions and incentives to reduce tax burden.

- Appreciation — The long-term increase in property price.

- Forced Appreciation — Actively increasing property value through upgrades or better management.

- Reinvestment — Using profits to acquire additional properties and accelerate wealth building.

Click here for your copy of the 8 Profit Centres.Together, these profit centres provide multiple avenues for creating and sustaining wealth that don’t depend solely on the rise in property prices.

The Value of a Balanced Strategy

Recognizing these diverse profit centres allows investors to manage risk more effectively and optimize returns. For instance, positive cash flow can provide a stable income during times when appreciation stalls. Similarly, tax benefits and principal paydown often go unnoticed but compound investor wealth significantly over years.

Active strategies like forced appreciation enable investors to create value through their own efforts, independent of market cycles. Leveraging other people’s money responsibly can magnify gains, but also requires careful planning and understanding of financing options.

Practical Steps for Investors

- Don’t rely solely on appreciation; build a portfolio that balances cash flow, equity growth, and tax efficiency.

- Investigate every angle of a potential investment—financial analysis, market trends, tenant risk, and financing terms.

- Explore all financing possibilities, including traditional mortgages, private lenders, and creative structures.

- Develop a reinvestment strategy that puts profits back to work methodically over time.

- Have reserves, maintain flexible operations, and stay informed to weather changing conditions.

Lifelong Learning Matters

Real estate is an ever-changing field influenced by economic shifts and regulatory changes. Investors should commit to ongoing education—studying market reports, attending industry events, engaging with mentors, and keeping up with tax law updates. This continuous learning helps sharpen decision-making and adapt strategies as conditions evolve.

Successful investors aren’t those who predict every market move perfectly but those who understand the enduring principles of real estate wealth building and apply them consistently.

Building Resilient Wealth for the Long Haul

In a market where relying on appreciation alone is increasingly risky, embracing all eight profit centres creates a durable foundation. Whether it’s cash flow, principal paydown, or savvy reinvestment, multiple income streams provide stability and opportunity.

Real estate investing isn’t about chasing hot markets or hoping for easy wins. It’s about applying timeless principles with discipline and insight to build lasting wealth that can endure market ups and downs.

Gord Lemon, Co-Founder Real Estate Investment Institute | Real Estate Investment Trainer and CoachBook a strategy call: calendar.rei.institute/#/gord-lemon

Disclaimer

Paid editorial posts on Canadian Real Estate Wealth Magazine represent the views of individual authors and not necessarily those of the magazine or its editorial team. These posts are for informational purposes and do not constitute professional advice. The magazine does not guarantee the accuracy or reliability of the information in these posts and is not liable for any errors, omissions, or actions taken based on their content. Authors are responsible for their submissions and must ensure they do not infringe on third-party rights. Readers should verify the information and consult professionals before acting on it. Links to external websites in paid editorial posts are provided for convenience, and the magazine is not responsible for their content or availability. For concerns, please contact the author directly.

Recent Posts